Property prices

When trying to understand how the property market is performing at any one time, there are a multitude of different elements we look at with the market and overall economy to get a feel of where we are at. And also, where it is that we are going.

I often get asked questions like “what is happening with property prices atm?” and “ why should I buy now when the market has turned?”. Which are very valid questions that anybody should be asking when playing within the property landscape.

What I try to understand before answering these questions is, how are we looking across the board. And with the information at hand, how could we expect prices to perform for the near, mid and long term future. When assessing the information, I am trying to get a feel of such things like;

- Comparison of average income to median house prices

- Population forecasts / Supply and Demand

- Government stimulus

- Interest rates

When I review the current market, I see a few key indicators that give me confidence of continued strength within property prices for the not too distant future and beyond. Of course, interest rates have stabilised (and dropped off a little) pricing for the time being, but how long these make an impact for is something I am not 100% sure on. I will say this, that the need for price relief is real, so this isn’t a bad thing that’s happening now.

I will also say this, you don’t just make money with property through price growth, so when prices drop – this generally means opportunity can be ripe for the picking. “be fearful when others are greedy, and greedy when others are fearful” Warren Buffet

There are many ways to make money with property. But traditionally there have mostly been four – do you know what they are?

Median House Prices to Income averages

When it comes to housing affordability, there has been some obvious shifts over the last 20 years. In 2000, average incomes in Victoria were $34,745, and the median house price was $280,000. This represents a house price to income average of about 8 times.

|

Average income – Victoria – 2000 = $34,745 Median House price – Victoria – 2000 = $280,000 The median house price in the year 2000 was circa 8 times the average income. |

Now in 2022, we are seeing a median house price of $930,000 and an average income of $88,998. Which represents a multiple of circa 11 x income. Meaning it would take you an extra 3 years to pay off a home now (if no interest was applied).

|

Average income – Victoria – 2022 = $88,998 Median House price – Victoria – 2022 = $930,000 In the year 2022 the average income is circa 11 times the median house price |

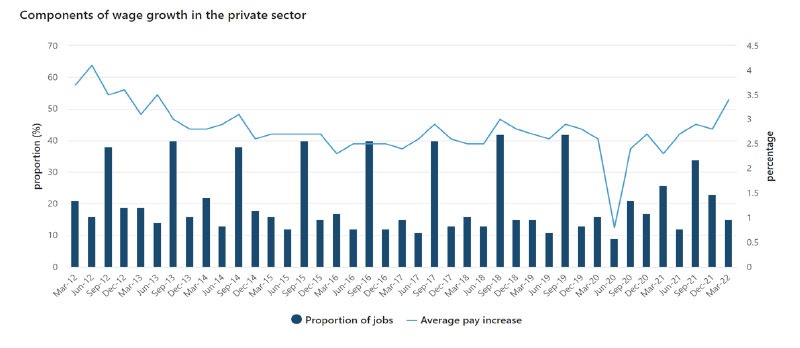

So, one of the key things we want to look at here is wage growth. Which has been quite stagnant for a number of years. But with unemployment being at the lowest it’s been EVER at 3.5%, can we expect wage growth to finally start picking up some slack and increasing?

Source: Abs.com.au

The above graph would indicate that we can. As a reasonably sharp increase in wage performance is evident. I like the look of this graph as it means peoples earning capacity may rise in competition with rising interest rates.

If wage growth grows, whilst pricing drops off slightly, then these comparisons may close up to levels closer to where we were at over 20 years ago. This to me is a good sign that we are on the right track with property prices and should continue to see this increase for a long time to come.

Population Forecasts / Supply & Demand

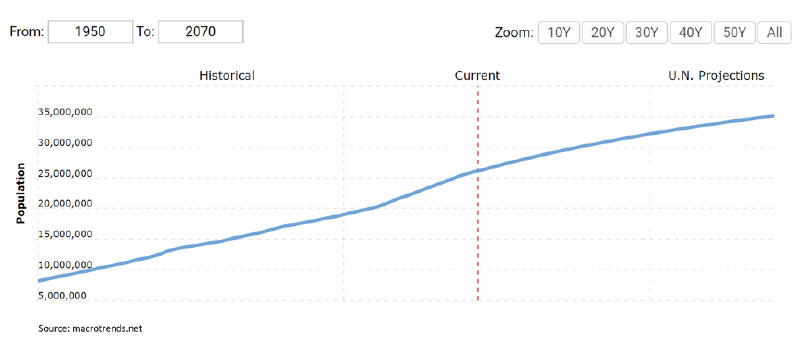

The next key factor I usually look at, remembering that this article is focused on the macro environment, not micro. Is the population growth and forecasting for any one region we are looking to assess. There are several great ways that you can find this information, but I like to use the abs.com.au page as its very detailed and updated government reporting.

Currently Australia’s population sits at about 26,000,000 people (26M). By the year 2070, this will likely be a population of about 35M people. This is 9 more million people than we have in the country now. And guess what, they will all need jobs and roofs over their heads. Which is why housing will always play such a huge role in any developed nation with exceptional positioning for expansion. If you think about the size of our country, and how few people that live within it, I find it a little scary to think of where we could be in 50 years time and beyond. Look at the size and prices in places like New York, London and Hong Kong. The upside potential within our country is exceptional.

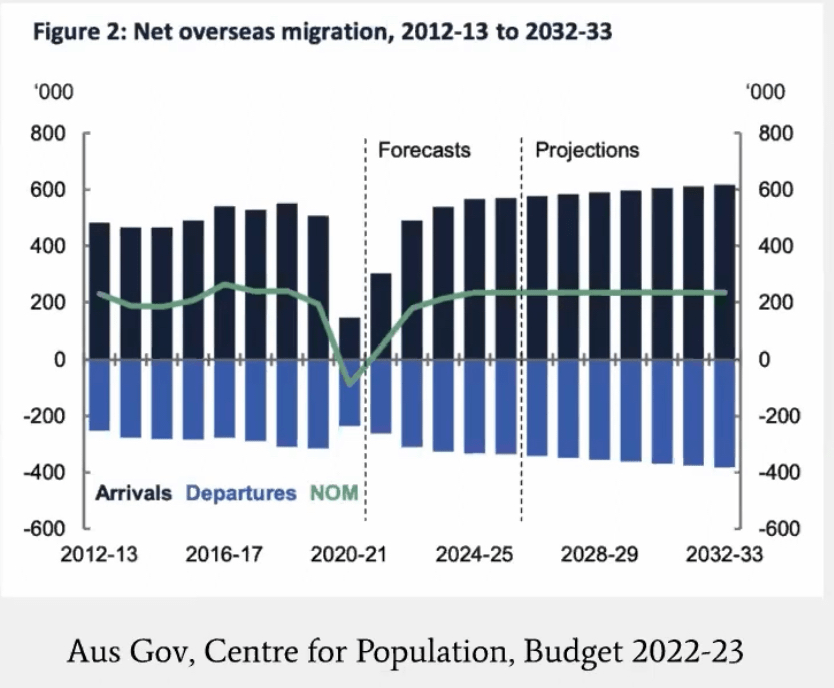

The below graph demonstrates how overseas migration is looking to perform over the next 10 years. Minus out departures and we are looking at an extra 200,000 people arriving on our shores every year for a long time to come. What we tend to see, is about 120,000 – 150,000 of these people decide to move to Melbourne or Sydney, which is a big reason why prices are strongest in these regions. So, we always want to try and understand what is set to occur population wise in any area we are considering to invest in.

Government Stimulus

Since the beginning of the pandemic, the Australian Government have committed nearly $300B towards stimulating the economy and keeping it afloat in response to Covid 19. The FHB market (state and federal) got a huge boost with large FHB grants and support schemes to help FHB’s get in the market and start owning over renting. This saw huge spikes in buyer activities across the industry, and placed pressure never seen before on builders and land developers. As supply chains were heavily impacted, we seen a huge shortage of materials and trades people to fulfil jobs within the system. This led to large price increases in the home building space and put incredible pressure on building companies to honour their commitments.

As this stabilises, I expect that we can see prices plateau a little bit. Until migration fires up (discussed previously), business sentiment improves, and we adjust to the new norm of regular rates and cost of living. Then look out, as all leads towards continuing strength in our most important contributor to the economy (Property).

The good outcome from this was the increase in home ownership for young people. But we need to keep in mind that this still needs support. There are talks of government shared equity schemes coming soon, and other ideas that are being brought to conversations with industry leaders. Our government is very Pro-Property, and have always supported it due to its importance in the way that we live. In Victoria, the property industry contributes in some way or form towards 59% of our overall GDP.

The 25th of October will be an important date for our industry as the Federal Treasurer delivers his budget for 2022-23. I am confident we will see some exciting new incentives for property owners and that sentiment will improve.

Interest Rates

The next thing worth looking at is interest rates and where they are positioned. This has been at all time lows for over 10 years and were always going to come back at some stage. We have been talking about it since forever (it feels like) and it’s now here. We can see what the RBA are doing, with 2.25% worth of increases in just 5 months, they are rapidly working to get this back to a normal reserve rate. Which will likely sit at somewhere between 3-5% I would say (but who really knows).

Source: ABS.com.au

Now, whilst this scares most people (especially the ones that have stretched themselves) it generally means very good things are happening within our economy. It means that GDP is back on track to where we want it to be, and unemployment levels are strong. Yes, these changes will affect house values short time to a degree, but long term I see this as being a normalisation of the economy which will likely lead to strong growth in wages and overall business wealth (meaning more jobs). This will also bring down inflation and the cost of living which will likely free up further disposable funds for family once things have levelled out. Other things we are seeing is the dramatic increase in wealth of Australians. With the residential property value recently hitting $10T! This means that Australians have equity, and if they are smart, they’ll use it to leverage further. We have also seen rent prices go through the roof, whilst vacancy rates have gone through the floor. These are good things for investors who own assets as the landscape changes.

The real lesson here is to avoid going out and spending more than you can afford. Unfortunately, too many people got caught up in the emotional wave of the market over the last 2 years and spent too much. They didn’t think of the changes that could arrive, and now need new strategies to overcome these challenges. We also love to spend money that isn’t ours on luxury items in Australia. If credit cards can be used more in ways that can benefit families, instead of hurting them – then we are on to a good thing.

Conclusion

In finish, my response to these questions is always this. Own property! And own as much of it as you can. Don’t wait, if you can act, then act. Don’t be zealous – be calculated. But opportunities will always exist in our space. If one state or suburb is struggling, then it doesn’t mean others are. When we understand the economy as best we can, we position ourselves to benefit over those who don’t. This is why I believe our kids need to understand this information and how to use it from a young age. We don’t need to know how to add and subtract anymore, we have phones that do that for us. What we do need to know, is how to build financial stability and skillsets that matter. And most importantly, we need to know how to build happy lives filled with love and connection.

We know what the difference is long term for those who own and invest over renting (not always by choice), so we need to keep acting upon it. Too many people are retiring below the poverty line in Australia (about 34%), and it’s all come down to their lack of assets (Super, Property or Shares). So, lets keep acquiring, building our wealth so that our future generations can learn and benefit from our hard work and care for ourselves.

As always, “be brave, go above and beyond and back yourself’

Matt Ellul

Director at BuyFair Property Group