House prices in Australia

House prices in Australia

House prices in Australia, like in many other countries, are influenced by a complex interplay of various factors. These factors can change over time and are subject to economic, demographic, and policy shifts. Below we discuss some of the most influential factors affecting house prices in Australia and some considerations for how they may continue to impact prices moving forward:

- Interest Rates: The Reserve Bank of Australia (RBA) sets the official cash rate, which influences mortgage interest rates. Lower interest rates tend to stimulate housing demand, as they make borrowing more affordable. In response to economic conditions, the RBA may raise or lower rates, impacting house prices. In the last 3 months we have seen rates held stable at 4.1%, this is no doubt leading towards more positivity with sentiment for home buyers of all types.

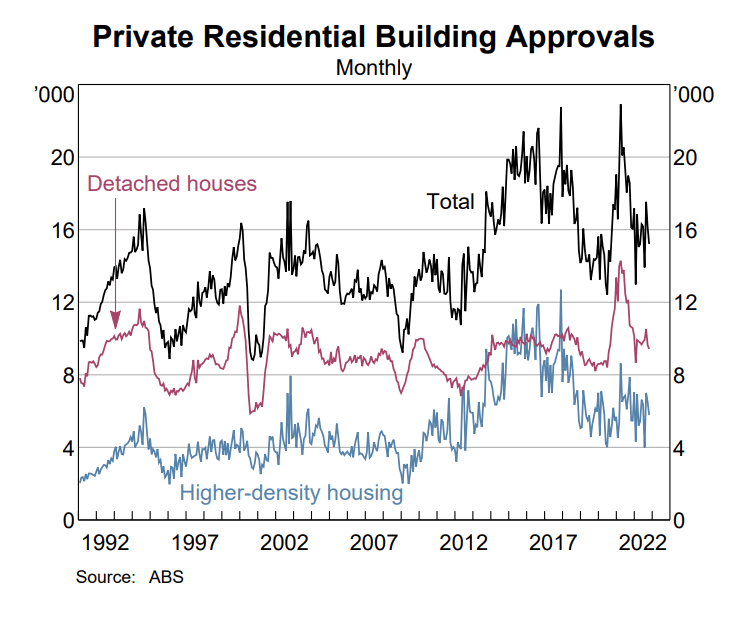

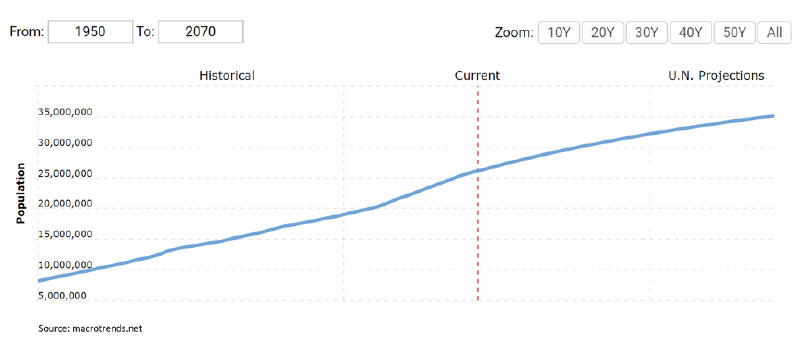

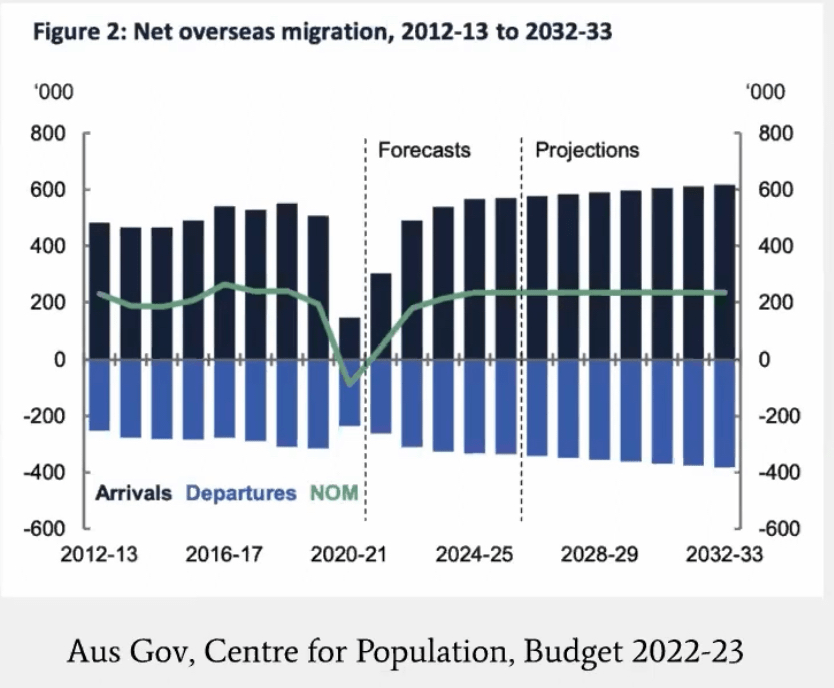

- Supply and Demand: The balance between housing supply and demand plays a critical role in pricing. Factors such as population growth, immigration levels, and housing construction rates can affect this balance. With a 900,000+ person boost to the Australian population expected over just the next 2 years, there is no doubt that this places pressure on an already short supply number and could create upwards pricing in the future. Following those two years the ABS have forecast a whopping 200,000 people increase in our population per year for decades to come.

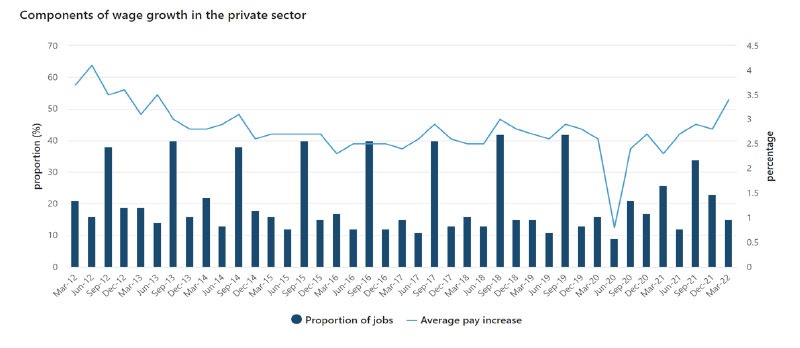

- Economic Conditions: The overall health of the Australian economy, including factors like GDP growth, employment rates, and consumer sentiment, can impact people’s ability and willingness to buy homes. Unemployment rates have remained low for 2 years following lockdowns which is likely to lead to more housing activity in the near future.

- Government Policies: Government policies can have a significant influence on housing prices. For example, incentives for first-time homebuyers, tax policies (like capital gains tax and negative gearing), and zoning regulations can impact both supply and demand. Currently state governments are having a big impact on certain industries within the property landscape and will continue to contribute towards how various sectors perform.

- Foreign Investment: The level of foreign investment in Australian real estate can affect prices, especially in major cities like Sydney and Melbourne. Government policies regarding foreign property ownership can influence this factor. In recent times we have seen a huge decline in the performance of residential real estate in China, which has led to a new surge of international investors entering our markets again. This puts more pressure on local buyers to compete against cashed up investors.

- Urbanization and Infrastructure: Infrastructure development and urbanization trends can affect housing prices. Areas with improved transportation links, amenities, and employment opportunities tend to see increased demand and rising prices. Major arterial projects like the West Gate tunnel can have short term implications and medium term outcomes that support house owners. Following infrastructure investment can be wise if done correctly.

- Consumer Sentiment: Consumer confidence plays a role in the housing market. When people feel optimistic about the economy and their financial prospects, they are more likely to buy homes. This comes down to household savings, employment stability, state of the market and equity in their homes.

- Global Economic Factors: Australia’s economy is influenced by global economic conditions. Events like global recessions or financial crises can have spillover effects on the Australian housing market. Major events like war, natural disasters and stock market happenings can all affect the way that house prices fluctuate.

- Housing Affordability: The ability of average citizens to afford homes is a crucial factor. High prices relative to incomes can lead to decreased demand and potentially slower price growth. Since 1930, the cost of a house compared to your average income has changed dramatically. Hence the need for more affordability with homes and social housing.

- Speculation and Investor Activity: Speculation in the housing market, driven by investors looking for capital gains, can lead to price bubbles. Government policies aimed at curbing speculative activity can influence prices also.

Moving forward, it’s essential to keep in mind that the real estate market is dynamic, and factors influencing house prices can change over time. Economic conditions, government policies, and global events can all impact the housing market. Therefore, it’s advisable to consult up-to-date sources and experts in the field to gain a more accurate understanding of the current and future factors influencing Australian house prices. We always say that having a long term approach to investing in major areas with lots of driving forces is the way to go. Speculating with high risk property investment is not our approach and can lead to damaging outcomes.

To learn more about working with us, please book a time with our team on the link below.

Happy Investing,

Matt Ellul

Director – Buyfair Property Group

Recent Comments