Over 600,000 Australians choose to manage their own super funds to buy property these days. Yet, using super to invest in property is still something very few people know little about. It’s almost like super is forgotten about in our younger generation as it’s something they will get around to understanding when they are ready to grow up and see retirement on the horizon. But how close to the horizon can one be before the whole chance of influencing your retirement outcome has deteriorated?

Unfortunately, this is something I see in clients aged 45-60 way too often! They’ve simply left caring about their super for way too long and have lost most of their ability to influence how it’s going to look at maturity. This also comes into play for people simply still wanting to get ahead in life and even wanting to still secure their first home. Often, we have to look at the super option as buying their own home still isn’t realistic due to a lack of planning and preparation.

There are some seriously attractive advantages to using super to acquire property. I have listed some of these benefits below.

1. Control

When you set up a SMSF, you give yourself the ability to take back control of where your earned money is directed. Most people have their money in an industry fund which is managed by a broker or account manager. All decisions as to where your money goes is made by your provider, meaning you have less control over what can be done. Now, a lot of people actually like this, and you can still decide to have someone manage your money for you in a SMSF account. It just means that you are able to influence where they invest it should you want to take a different path. They say that with fees in an industry fund, there are the ones you do see and the ones that you don’t. We also don’t know exactly how much of the profit is being kept by the industry fund and how much is shared. If you own a property portfolio in Super, then you know exactly where that is always positioned. And the profit is yours! Now that’s what I like to call control.

Most people set up an SMSF so that they can invest into a property or shares. Property being the predominant reason over shares. But you can invest in anything that has the ability to make you money. As long as its sole purpose is an investment, then you can do that. For example, if you want to buy collectable art then you can, you just cant hang it up in your home. It needs to be for investment purposes and nothing else.

2. Tax advantages

There are some seriously good tax advantages when investing in Super. Now I am not a financial planner, so am not licensed to discuss tax in detail. But the best things to this when investing in property are the discounts in capital gains tax (CGT) that you get. Depending on when you sell an asset (during working years or in retirement) you may pay $0 CGT at all. If still working then you will be looking at 10%, but it all comes down to each persons position. Please seek proper advice around this before you make any formal decisions.

The other major tax advantage that you may be able to benefit from is the tax rate on income (rent) once you are retired. It can be nothing if done properly. And who doesn’t love not paying taxes? It’s a bloody big advantage when trying to set yourself up and live your best life.

3. Leverage

The next major advantage of investing in to property is that you gain access to compounding growth on a larger asset value. For example, if you currently have $200,000 in super and it’s all being invested in to shares, then 10% of this value will be $20,000 profit (less fees). If you own a property and bought it for $500,000 for example, and it grows at only 8%, then your profit will be double of the shares profit at $40,000. What you also need to keep in mind with property is that it has multiple income streams also. Meaning its not just the value of the home going up that makes you money. You have the rental income, tax advantages and depreciation (depending on the age of the property) also. Below is an example of how leverage can work outside of super. It’s one of the main reason that the rich get richer, as they’re able to leverage their existing assets to continue building more.

4. Brick wall between personal and super

When we invest using our Super. We also need to understand that it makes no impact on our personal position whatsoever. If you are looking to borrow money in your personal name, then at no time will a bank ever look in to your super borrowings to decide what you can lend. Essentially, there Is a brick wall between the two meaning they are totally divorced of eachother. The best way that I like to describe this to people is that your SMSF is like a business, and lending is almost looked at like a business loan. And your personal position is just that.

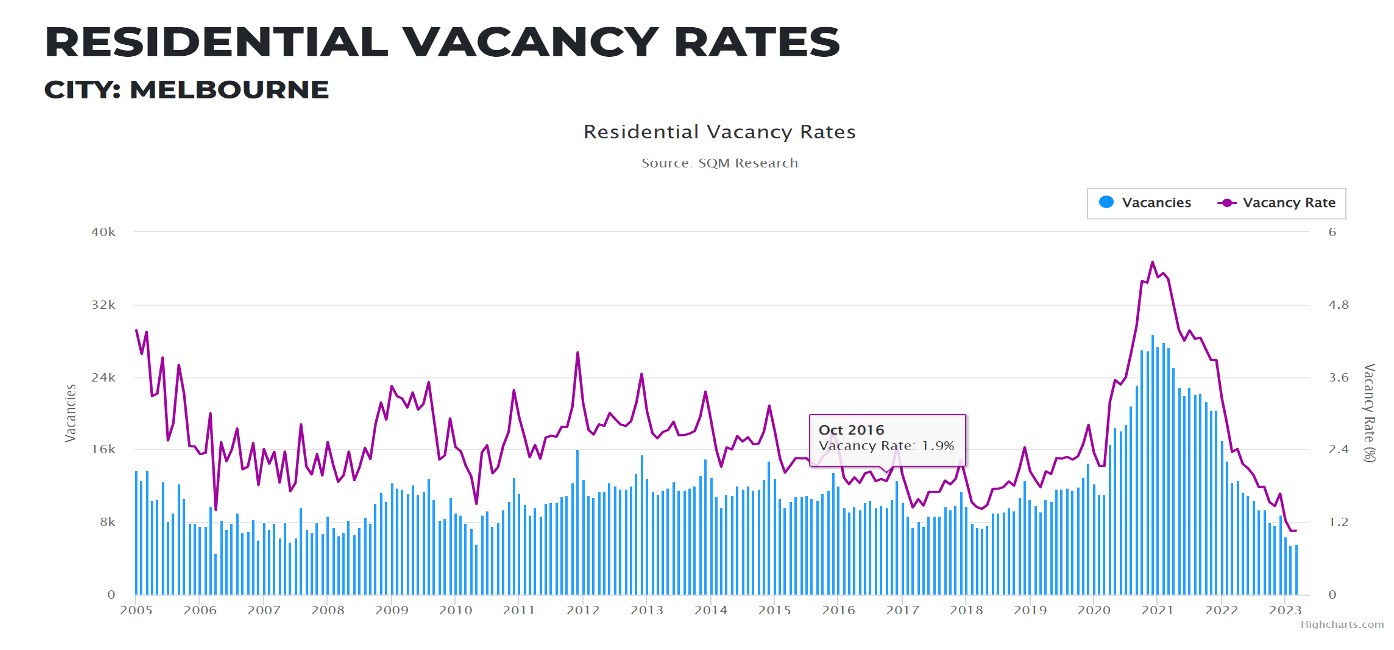

I’ve seen a number of times in the past 15 years where clients of mine have lost a lot of money that they have in their super. And very quickly! This is because the share market is more volatile than property. Why? Because people will always need a roof over their head. And we don’t have enough homes built to house every person. Meaning that we have a shortage, and a shortage means growth as people compete to buy them. Should you be getting closer to retirement then you want to be lowering your risk appetite (ideally). Owning property is considered as the lowest risk investment that you can make long term. So having bricks and mortar can be a really good insurance play when protecting yourself against economic downturns.

As we know, buying property for investment purposes means that we don’t need to be restricted to where our lives are taking place. We have the flexibility to decide on where our assets will exist, and can enter in to any market place that we wish. I personally see SMSF as a great way to further build your wealth safely. But as mentioned above, it’s always important to understand why it is you’re investing in to an area and what that can do to us.

Recent Comments