Everything you need to know about land contracts

Everything you need to know about land contracts

View translated article:

इस लेख को हिंदी में पढ़ें.

阅读这篇中文文章 简体

Topics Covered

- What is a Contract of Sale?

- How do Online Contracts work?

- How does Paper Contracting work?

- Explaining the Contract of Sale

- What is a Cooling-Off Period?

- What are the Particulars of Sale?

- What is a Vendor’s Statement?

- What is a Sunset Clause?

- What is a Special Condition?

- How does the Deposit work in a Contract?

- What does Exchanging a Contract mean?

Firstly, what is a Contract of Sale?

An agreement produced by a lawyer to formalise the sale of real estate. This includes all the information on the subject property, conditions tied to the sale, who represents the buyer/seller and all of the buyer & seller information.

You can sign a paper contract or an online contract. How do they both work?

Your contract can usually be signed in paper form, or online. Online is becoming more common. The contract can be signed on your behalf by someone who you have appointed as your power of attorney.

How Do Online Contracts Work?

To sign online, you have to provide a separate email address for each person signing. You have to check that the contract has been filled in fully and correctly before you sign.

Will signing an online contract hold up in court?

Yes. The Australian Electronic Transactions Act of 1999 (ETA) says that electronic executions of contracts are valid under common law as long as the signing party has authority and has been identified properly.

How do they know it’s me who signed?

To prove it’s your signature, different services have different criteria. This can come in the form of identification apps, SMS verification and utilising your personal email.

What is the main service used?

The majority of services use ‘DocuSign’ technology. DocuSign uses a mathematical algorithm that acts like a cypher (secret code), creating data matching the signed document, called a ‘hash’, encrypting that data. The resulting encrypted data is the digital signature. The signature is also marked with the time that the document was signed, and says what computer/device it was signed on.

Simply put, their technology prevents fraud and can confirm a legal signing.

Has it been proven in court?

Yes, e-signing has been proven to be legally valid both here in Australia and abroad.

Will anyone have a problem using online contracts?

Rarely, since the introduction of PEXA, the majority of the property market has adopted it.

Typically, how would it work?

- Provide your details to the real estate agent, including:

- Full Names, Address, contact information and Conveyancer information.

- The real estate agent produces the contract.

- You receive an email with a secure link to review and sign the contract.

- At the same time, your conveyancer receives a copy.

- If satisfied, the service will walk you through where to sign with digital ‘tabs’.

- Once all parties have signed, you will receive a copy of the executed (signed) contract for your records.

- You will then be expected to pay the deposit immediately.

How does Paper Contracting work?

The process is very similar, just more manual.

The agent will present you with a paper copy of the contract of sale.

- All parties entering into the agreement will be added to the contract of sale.

- You sign your offer; the agent presents this to the vendor.

- The vendor countersigns the offer, and the contract is now ‘executed’ (complete).

- The agent typically provides you with:

- A copy of your signed version for your records

- A copy of the executed contract

Explaining the Contract of Sale

To keep this simple, there are a few main components that we’ll cover; anything too specific is best explained by your Conveyancer.

The first few pages – ‘Contract of Sale of Real Estate’

Both the people/entity purchasing the property and the seller sign this initial page

This confirms that the vendor agrees to sell the property and the purchaser agrees to buy the property.

This confirms that the agreement is legally binding and that both parties agree to the terms of the contract.

These initial pages also note the cooling-off period.

What is the Cooling-Off Period?

Even though you have signed the contract, you have three clear business days (VIC) to change your mind and end the contract. But you must notify the Vendor or its agent in writing within that time.

There are exceptions to this:

- You bought the property at or within three clear business days before or after a publicly advertised auction.

- The property is used primarily for industrial or commercial purposes.

- The property is more than 20 hectares in size and is used primarily for farming.

- You and the vendor have previously signed a contract for the sale of the same land in substantially the same terms.

- You are an estate agent or a corporate body.

Other states and territories have different cooling-off periods.

- VIC – 3 clear business days

- NSW 10 clear business days

- QLD – 5 clear business days

- WA – No cooling-off period

- NT – 4 clear business days

- SA – 2 clear business days – buyer only (Depending on when the buyer receives Form 1.)

- TAS – 3 clear business days (This is an optional box that you must tick ‘applies’)

- Australian Capital Territory (ACT) – In the ACT, there is a cooling-off period of five business days.

It’s important to note that these regulations can change, and there might be exceptions based on specific circumstances or contract terms. Buyers and sellers should consult with legal professionals or conveyancers to fully understand their respective states’ cooling-off periods and other contractual obligations.

Is my deposit refunded if I cancel the contract during the cooling period?

- VIC – You are entitled to a refund with only $100 or 0.2% of the purchase price deducted, whichever is greater .

- NSW – YES – 0.25% of the purchase price

- QLD – YES – 0.25% of the purchase price

- NT – No penalty

- WA – Doesn’t apply.

- SA – YES – $100 fee.

- TAS – Nil (if selected).

- ACT – YES – 0.25% of the purchase price.

What are the Particulars of Sale?

The particulars of sale in a contract in Australia are the specific details and terms that outline the agreement between the buyer and the seller when purchasing a property. These particulars, which are close to the front of the contract, provide clarity and legal protection for both parties involved in the transaction.

What is a Vendor’s Statement?

The term ‘Section 32’ is specific to Victoria. The Vendor’s Statement is a legal document provided by the seller of a property to the potential buyer before the sale of the property. The purpose of the Vendor’s Statement is to provide important information about the property, its title, and other relevant details to help the buyer make an informed decision.

The Vendor’s Statement typically includes information such as property details, encumbrances/restrictions, zoning/planning information, outgoings, ownership, title and more.

The ‘Vendor’s Statement’ Must be Signed by the Vendor First

The vendor must sign the Vendor’s Statement to confirm the details within the document are correct. The copy you review should already be signed; if it isn’t, ask for it to be.

Why do I have to sign the Vendor’s Statement?

It mainly protects the agent. It confirms that the real estate agent delivered a copy of the vendor’s statement BEFORE signing the contract of sale.

Does every state/territory need one?

No. Only vendor’s in Vic, NSW, and ACT are obligated to obtain and disclose certain information, as per state government legislation.

- VIC – Required. Also known as ‘Section 32’

- SA – A similar document known as the “Form 1” disclosure is typically provided by the agent.

- TAS – Not required.

- NSW – Required.

- QLD – Not required.

- ACT – Required.

- WA – not required, but typically, the agent will provide a ‘Sellers Disclosure Statement’

- NT – Not Required.

https://wlegalgroup.com.au/property-coach/2022/05/16/property-sales-disclosures/

What is a Sunset Clause?

A timeframe for certain conditions to be met for the contract to proceed. If the conditions are not met by the specified date, the contract may be terminated (VIC). Usually this relates to completing the roads etc for a subdivision, and having the plan of subdivision registered.

Can the vendor cancel under the Sunset Clause?

No, only the purchaser can (VIC).

Why? If the vendor (developer) sold the land in 2019 and by 2020, it went up by 25%, it prevents them from purposefully delaying development in order to cancel the contract under the sunset clause and re-listing the property for a higher price.

What is a common situation where a ‘Sunset Clause’ would be used?

You signed a contract in 2019, and the developer still hasn’t titled the land. Typically, your contract will have a ‘sunset period’; once this is reached, you can either cancel the contract and receive your deposit back or sign an extension.

How Long is the Sunset Period?

It is different for every contract. You will typically see 36-48 months.

Does a sunset clause exist in all states/territories?

- VIC – Yes, required by law and only the purchaser can cancel (although Vendors can give themselves rights to not proceed if conditions such as sales, finance etc are not met by a certain date).

- SA – Yes, either party can terminate.

- TAS – Yes, either party can terminate.

- NSW – Yes, required by law and only the purchaser can cancel (although Vendors can give themselves rights to not proceed if conditions such as sales, finance etc are not met by a certain date).

- QLD – At present either Vendor or Purchaser can avoid the contract, but there is a bill before Parliament restricting the Vendor’s rights to do so.

- ACT – Yes, required by law and only the purchaser can cancel (although Vendors can give themselves rights to not proceed if conditions such as sales, finance etc are not met by a certain date).

- WA – Yes, either party can terminate.

What is a ‘Special Condition’?

A special condition is a clause added to the contract specific to your agreement and usually addresses unique circumstances.

Example: A new special condition is added, allowing you to make the contract subject to the sale of your existing property. So, unless you sell your property, the contract remains conditional to suit your circumstances.

What are ‘Definitions’ in a Contract used for?

The explanation of what certain words mean in a contract. This further clarifies what a statement means when reading through it. It’s very important to understand what the exact definition of a word is so you understand what you’re agreeing to.

How does the Deposit work in a Contract?

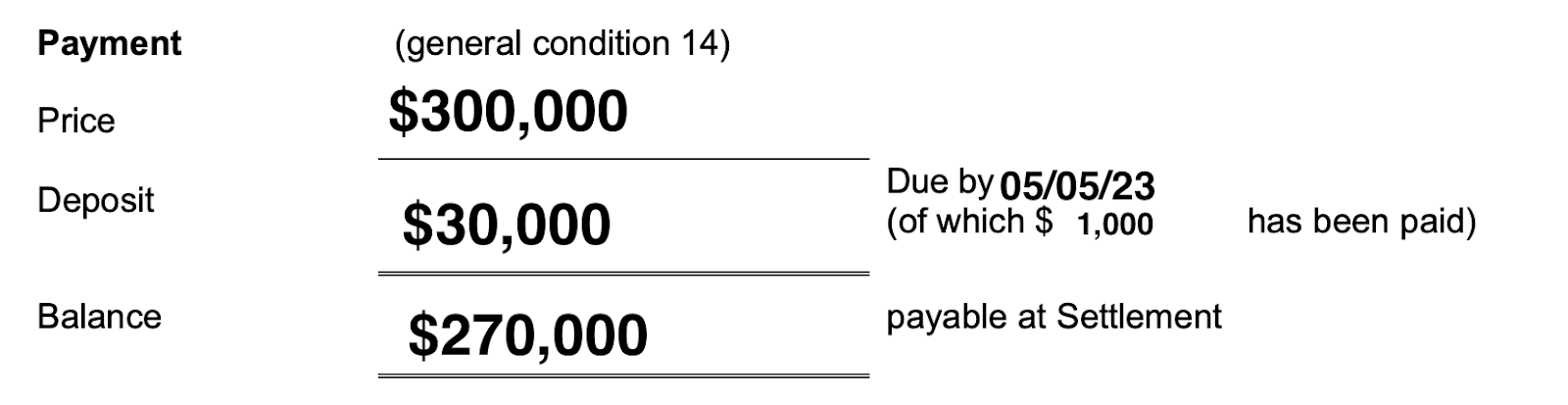

- Under the deposit section, the price for the block of land will be listed.

- The ‘Deposit’ field will then show the total deposit amount. They can only ask for up to 10%. This section will also mention when the deposit is due.

- It should also stipulate what has already been paid (i.e. a $1,000 holding deposit)

- And then show the remaining amount you owe.

- The Deposit has to be held in a trust account, until all conditions have been satisfied (such as completing the roads and registering the plan of subdivision).

In this example, you would owe $29,000 by 05/05/2023 because you’ve paid a $1,000 holding deposit. At settlement, you must pay $270,000 to settle the land.

What does Exchanging a Contract mean?

An exchanged contract means that all parties agree and have signed the contract.

It typically works in the following way:

- You sign your contract, and it is sent as an offer to the vendor (developer/owner)

- The vendor agrees to the offer and signs the contract.

- You receive a fully signed version, meaning all parties agree, and the contract terms are now in effect.

- This will often be signed, and copies provided, electronically.

Produced by BuyFair Property Group in collaboration with Colin, Biggers & Paisley Lawyers & Openlot.com.au

BuyFair Property Group provides off the plan investment options and education. With Australia’s first ‘Investor Centre’, BuyFair Property Group offers free education and guidance on all the main components of property investment.

Colin Biggers & Paisley has a century-long history of genuine expertise in transactions, projects, governance and dispute resolution. They are particularly known for their insurance, property, and construction experience, and have an established reputation in a range of other sectors.

Openlot.com.au is Australia’s leading off-the-plan platform. Discover land for sale, house & land packages, townhouses for sale in Australia with estate info, releases & settlements, construction updates and more.

Definitions & Terminology

Contract of Sale – An agreement produced by a lawyer to formalise the sale of real estate. This includes all the information on the subject property, conditions tied to the sale, who is representing the buyer/seller and all the buyer & seller information.

Section 32/Vendor’s Statement – This is a legal document provided by a seller which is enclosed in the contract of sale. This document contains all the information about the property and is a requirement by law. It must include all the information that may affect the state of the property, especially if it could impact the decision of the buyer.

A vendor’s statement must be signed, accurate and current. If not, it may provide an opportunity to void the agreement.

Particulars of Sale – The particulars of sale in a contract in Australia are the specific details and terms that outline the agreement between the buyer and the seller when purchasing a property. These particulars, which are close to the front of the contract, provide clarity and legal protection for both parties involved in the transaction.

Sunset Clause – A timeframe for certain conditions to be met for the contract to proceed. If the conditions are not met by the specified date, the contract may be terminated (VIC). Usually this relates to completing the roads etc for a subdivision and having the plan of subdivision registered.

Special Condition – A special condition is a clause added to the contract specific to your agreement and usually addresses unique circumstances.

Recent Comments