Your next Investment Property Can Now Return 10%+

Your next Investment Property Can Now Return 10%+

Produced by BuyFair Property Group

A ‘Multi-Liv’ Property Returns on Average $7,350* per month

A Standard Residential Investment Property Returns $2,200 per month

Based on these average returns, you are $60,000 + in front per year using ‘Multi-Liv’.

*The returns above are examples only, are subject to market conditions, and may change at short notice. All estimates are based on third party marketing information.

Topics Covered

- What Multi-Liv is

- The returns v. Standard H+L

- How it works/guarantees with BF

- What you have to do to achieve a co-living (multi liv) property

- Financing

- Tenancy/property management

What is Multi Liv investing?

Multi-Liv investing is a new way of investing that’s changed the landscape for everyday investors in Australia. Multi-Liv investing provides both investors and tenants with the opportunity for higher returns and lower rent.

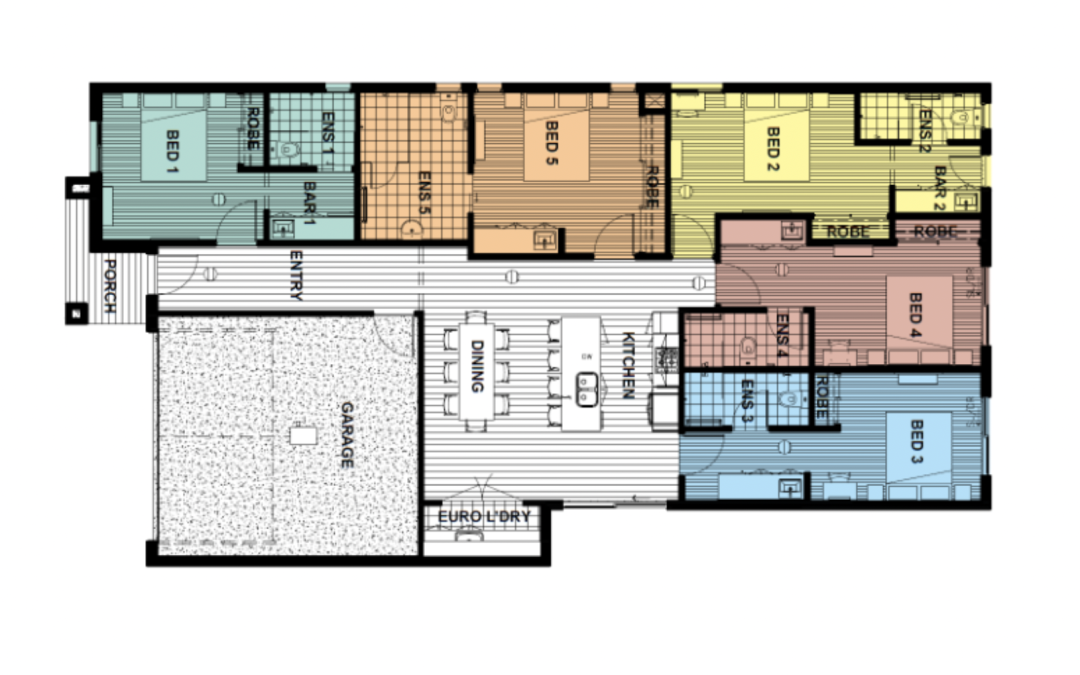

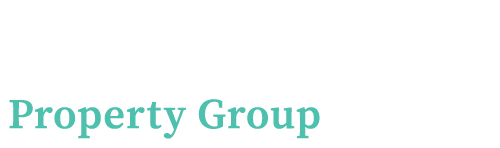

When designed in the right manner, a Multi-Liv investment will allow the housing of multiple tenants under one roof.

Simply put, this allows investors with a vehicle that generates multiple streams of income with only one purchase. Multiple streams of income are a key approach to generating wealth for the wealthy.

Not only does this support more investment, but it supports the affordable housing crisis by providing more quality and affordable rental properties for tenants in need.

When you build a 4 (bed) x 2 (bath) family home, you have the ability to lease it to a limited rental market for a limited amount (circa 4% of purchase value). When you have 5 individual rooms that can be leased at below-average house rates of an area/suburb and can produce a yield of circa 10%+, then all parties involved end up winning.

An example of a ‘Multi-Liv’ House Plan

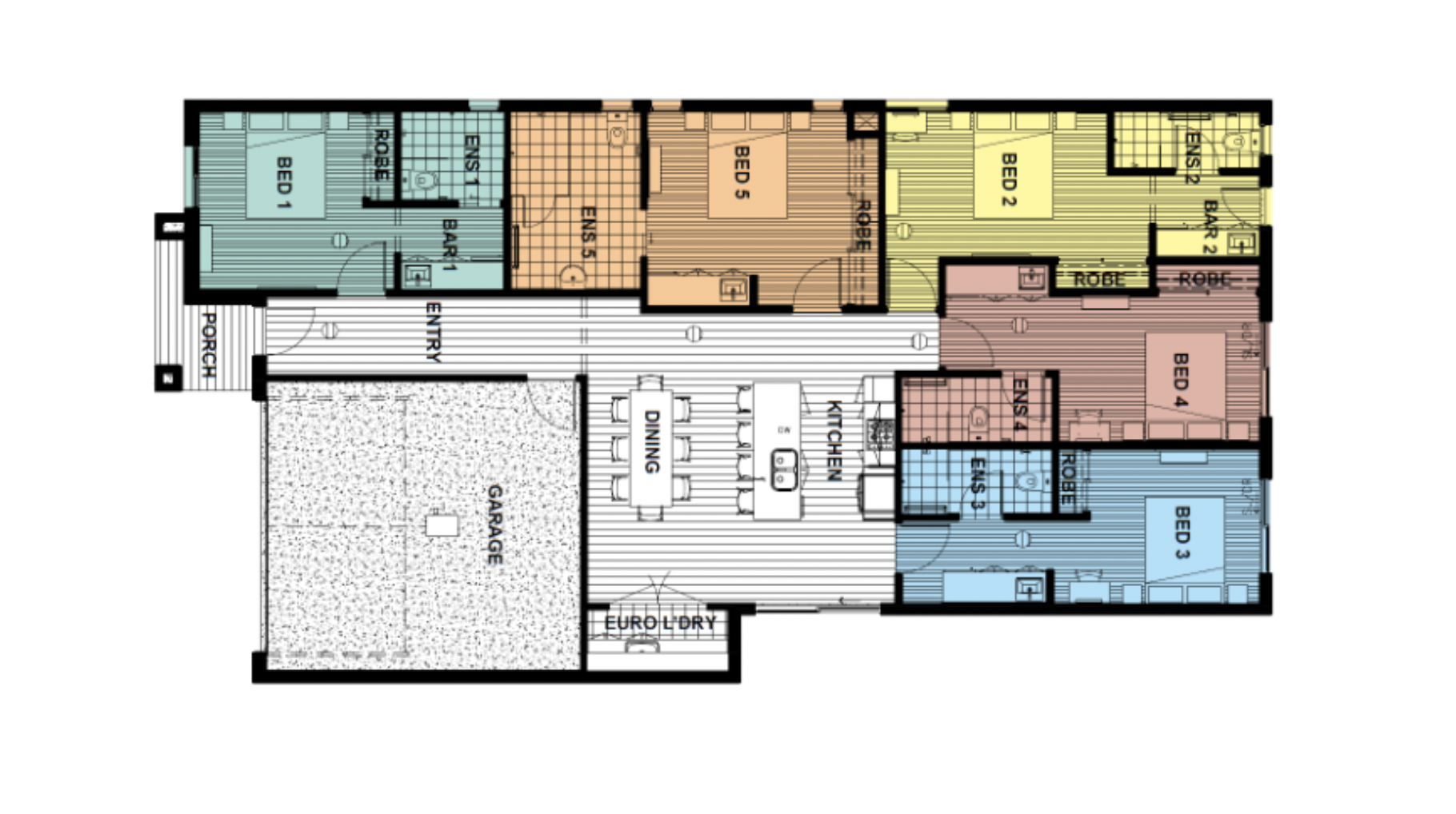

The returns Vs Standard H&L

It’s pretty simple when doing the math, providing that there is confidence around the amount that you can get for a room, then multiplying your income streams with a Multi Liv property makes the outcome for investors a lot better than getting a single amount of rental income. The below graph shows the potential difference between the two outcomes

If you own 5 x 1-bedroom units that are fully furnished with all that you need to live, then you have 5 time the amount of assets for cash flow purposes. A quick note that this also increases the value of your asset (when valued correctly).

This is investing intelligently and creatively. Wealthy investors understand how to increase the value of an asset. Think about the homeowner who builds a granny flat at the back of their house, now they can earn extra income while living in their own home with complete privacy. It’s logic in its ultimate form.

Investing is all about using your head and not your heart. It should be a non-emotional decision that focuses on dollars and cents, not the colour of the carpet/curtains. If the numbers look better with one approach over the other, then the decision should be in that direction. Don’t worry about whether one option costs more than the other (a mistake often made). Worry about how much it will cost you to hold the asset – as the growth in its value will come.

How it works and Guarantees with BuyFair Property Group

The first step to understanding whether a Multi-Liv investment could work for you is to speak with the team at Buyfair Property Group. The first thing that they will do is get an understanding of your position and suitability to lend for a Multi-Liv property (with your approval).

From there, if lending looks possible, and you have an interest – they will work with you to package up the best option suited to your lending abilities and motivations. Below are some of the requirements included with any one package that they put together for their clients;

- Negotiate a parcel of land to hold and assess

- Speak with the council about the suitability of a Multi-Liv property

- Assess the rough costs of packaging for land, building and furnishing

- Place an online ad to test demand for tenancy in that region

- Formalise a package price and offer and present it to you for a decision

On top of what you see above, every Buyfair Multi-Liv package will come with some or all of the below incentives (case by case):

- Rental guarantee (at an agreed amount for an agreed duration)

- Land leaseback that supports holding costs during construction

- Furniture pack offerings

Director of Buyfair Property Group, Matt Ellul said “We created the Multi-Liv range to give mum and dad investors confidence around investing with clarity once more. I wanted this to be as close to a ‘no-brainer’ investment as we could make it. That was how the vision to start the Multi-Liv range began”.

What you need to achieve a co-living (multi liv) property

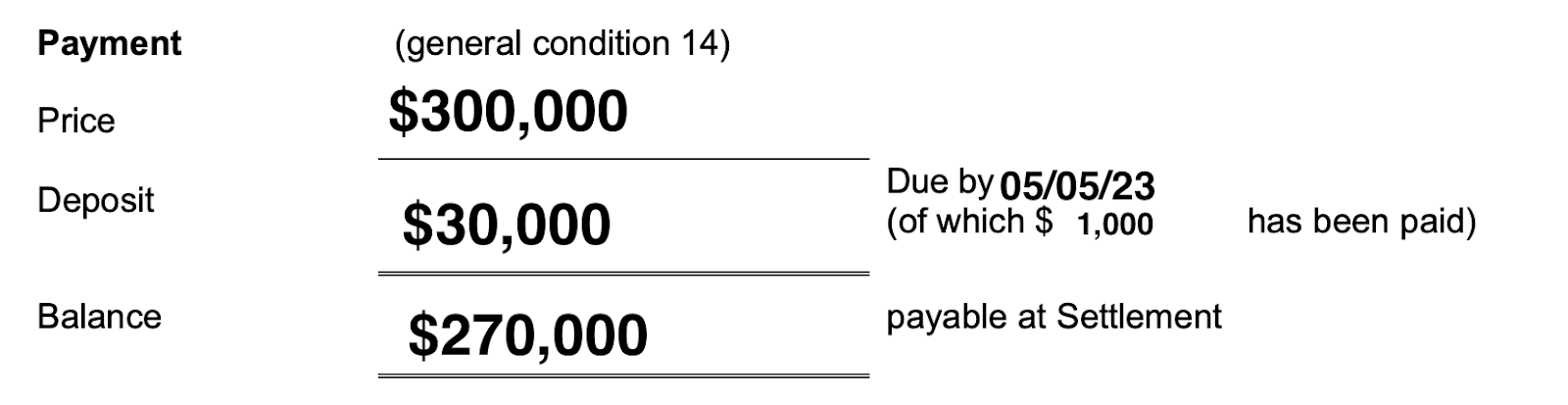

The first step of any investment is to understand what borrowing potential you may have. And what impact borrowing for a new investment could have on you. Investing in anything comes with an element of risk, so understanding both the upside and downside potentials of any investment is critical.

You also need to understand the holding costs of that investment and how much it can make you (see below)

- Cost of money being lent to invest (i.e. interest rate)

- Forecast duration to build the property and source tenants

- Amount of income being provided during construction

- Maximum amount of rent that can be achieved – and contingency amount if maximum amount does not occur.

- What long-term impact can investing (and not investing) have on my financial position?

- Speak with experts who can advise on the above matters

The above demonstrates some of the key points that we believe you should be ticking off before making any decisions to invest.

When investing, you can choose to go it alone or work with an advisor. Multi-Liv investing is not something to do if you lack the understanding of how to properly do it.

Financing a Multi-Liv Investment

When investing, financing your venture is almost the most important element of the whole thing. If we can’t get funding, then all of the above is for no reason as we can’t do it (unless you have the required cash).

We use specialist lenders that not only understand the approach of a Multi-Liv investment, but also understand how to value it. Normal lenders such as the big 4 often don’t review properties of this nature correctly, which can lead to a valuation issue as it’s more expensive than the other 4-5 bed homes being built.

Money is king! And those who have it, have control. So it’s critical that we treat the companies lending us money in the right manner. Our finance partners are experts in Multi-Liv lending and may also be able to help you tap into your superannuation to invest in a Multi-Liv property meaning that you may not need a deposit or equity loan.

We always encourage our clients to explore the financing in detail before committing to any purchase. In saying that, most Multi-Liv packages being provided will come with a finance clause to protect investors should they have issues with getting finance.

Managing a Multi-Liv Home

One of the main questions we receive in this space is around the management of Multi-Liv homes. Investors understandably want to know how this works and what it costs.

Firstly, Buyfair Property Group has aligned with the country’s biggest and longest-standing specialist management company who currently manage in excess of 1,500 rooms across Australia.

Typically, a 5-bed Multi-Liv house will cost 12% + GST plus inspection, letting fee and cleaning costs. Naturally, there is more involved with leasing a home that has 5 tenants instead of 1. So, the cost to operate this function is higher.

When you compare this with the management fees of a normal property, it doesn’t make much of a difference as the rental outcome achieved is a lot higher. For that higher cost, you get a lot of value.

It’s also important to understand that filling the rooms comes with a particular strategy which focuses on attracting a specific tenant type first, then building future tenants around that person. House rules also come into effect to ensure that tenants are allowing others the chance to live in comfort and peace.

One of the issues with traditional tenancy agreements in today’s world is the bias towards supporting tenants under the Residential Tenancy Act. A tenant can pretty much get away with whatever they want in a traditional agreement. This is not the case under a rooming house agreement. The bias is in favour of the landlord, meaning you can remove troublesome tenants who don’t pay rent or abide by house rules a lot easier. I can’t stress how important of a factor that this is! When we invest, we want to know that our resources are protected as best that they can be. This gives you more protection and is a big advantage that traditional Australian investors won’t get.

Things like monthly cleaning, fully furnished rooms and utility provision comes in to play with a Multi-Liv house also and is managed by your specialist manager.

Produced by BuyFair Property Group

BuyFair Property Group provides off the plan investment options and education. With Australia’s first ‘Investor Centre’, BuyFair Property Group offers free education and guidance on all the main components of property investment.

![BF-investment[30]](https://buyfairproperty.com.au/wp-content/uploads/2024/08/BF-investment30.png)

Recent Comments